File photo

Large wheat crops in major exporting nations have set up intense competition on the global market for U.S. wheat. Cash prices on the Southern Plains for hard red winter wheat reflect the ample supply.

Local prices continue to follow hard red winter wheat futures prices that have remained stuck in a narrow range over the last month. Global demand remains healthy at these lower price levels. Over the near term, the potential to develop a rally appears increasingly dependent on weather in U.S. winter wheat areas, barring a major geopolitical shock.

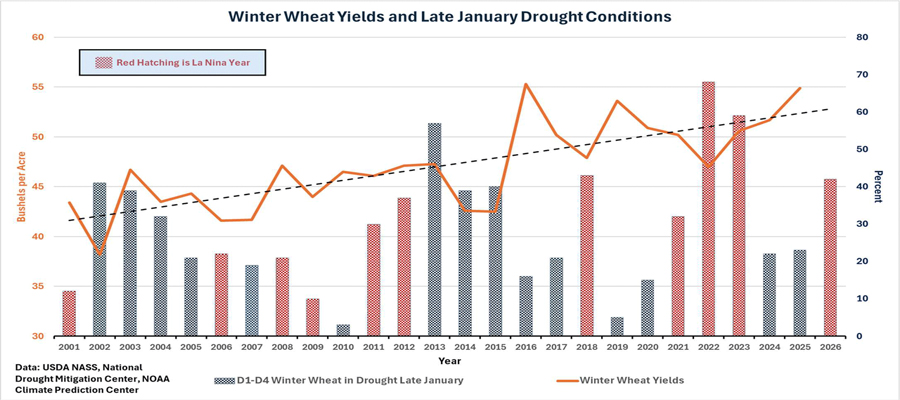

A narrative is developing about La Niña conditions this winter, creating a difficult environment to realize good wheat yields as drier- and warmer-than-normal conditions affect the crop. While it remains early, dry conditions persist across large sections of winter wheat areas, according to the National Drought Mitigation Center. Through Jan. 20, winter wheat area in drought sits above 40%.

The chart shows national winter wheat yields from 2001 to 2025 with the drought levels for the crop on Jan. 20. The red hatching indicates a La Niña event occurred during the winter of that crop year. Final yields do not always fall below trend under drought conditions at or above the present levels in January. The addition of La Niña conditions can affect yields, but the outcome is far from assured.

The narrative around La Niña conditions and drought levels will continue through the first quarter of 2026. With this speculation, expectation of a weather premium coming into the market is reasonable. The likelihood of a price rally is rising due to the risk of winterkill caused by winter’s dry start in the Southern Plains.

After the initial enthusiasm for trade deals and various purchase announcements in early November, hard red wheat futures markets settled into a range-bound pattern. March hard red winter wheat futures prices moved between a range of $5.05 and $5.35 since late November and show little evidence of breaking out at present. July harvest contract prices vacillated between $5.30 and $5.60 over the same period.

The prospect of eclipsing the Risk Management Agency’s projected harvest price of $5.61 set back in August and September seems difficult to achieve. Cash prices across Oklahoma have been running 80 to 85 cents under the March contract and 60 to 65 cents under July’s.

Given the global supply situation, a rally in weather related to the previously discussed narrative that sees July contract prices eclipse the projected harvest price may be a pricing opportunity. Without a deterioration in crop conditions that is verifiable and obvious, a weather rally may be fleeting. Setting target prices for old and new crop sales seems prudent given market conditions.

Source: Online/GFMM

Comment Now