File Photo

The global hammer mill market was valued at around US$ 3,231.2 million in 2022. From 2023 to 2033, global hammer mill sales are expected to rise at a steady CAGR of 5.3%. Total market value is projected to increase from US$ 3,389.5 million in 2023 to US$ 5,677.3 million by 2033.

Demand in the market is expected to remain high for lump breakers. As per Future Market Insights, the lump breaker segment will dominate the global hammer mill industry with a share of around 28.5% in 2023. It is anticipated that the worldwide market for hammer mills will expand steadily during the next ten years. This is due to the rising adoption of these machines across various sectors.

Key Factors Shaping the Market:

Growing usage of hammer mills across sectors such as food & beverage, agriculture, chemical, etc. is providing impetus to market development The surging need for high-efficiency grinding, milling, pulverizing, and chopping machines is expected to bolster hammer mill sales

Burgeoning demand for high-quality feed and biomass materials will likely boost the global market Growing emphasis on fine grinding and particle size control is projected to uplift hammer mill demand

The surging popularity of solar-powered hammer mills is set to support market expansion The development of low-cost hammer mill equipment is looking to foster market development

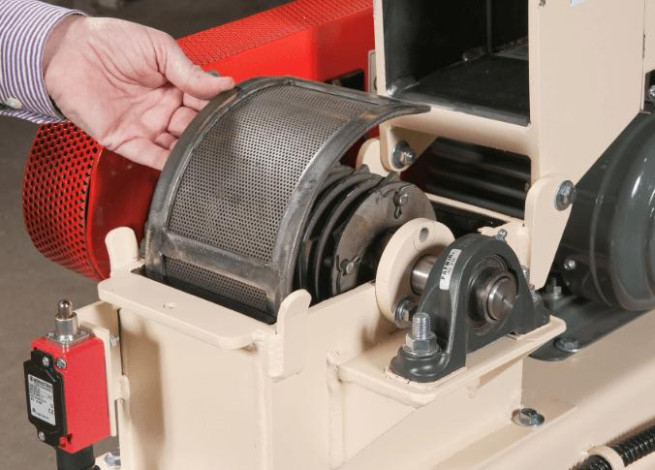

A hammer mill is a heavy-duty grinding machine that utilizes high-speed rotating hammers to crush and pulverize a wide range of materials. It is commonly used in sectors such as mining, agriculture, and biomass processing.

Hammer mills are known for their efficiency, versatility, and ability to handle a variety of materials, including grains, biomass, minerals, and recycled products. They are utilized in processes such as grinding, crushing, pulverizing, and shredding.

Hammer mills allow users to produce fine powders, aggregates, or controlled particle sizes suitable for further processing or use in various applications.

Hammer mills are widely used in sectors such as agriculture, biomass processing, and mining for grinding grains, biomass materials, and minerals to produce feedstock, fine powders, or controlled particle sizes suitable for various applications.

Global market expansion is being driven by technological developments in hammer mill equipment, such as increased grinding efficiency, automation, and ease of maintenance. Manufacturers constantly develop new products to fulfill market expectations and provide specialized services.

The demand for hammer mills can differ among different regions as a result of elements such as economic advancement, industrialization, and agricultural methods.

Hammer mills enable companies to increase their productivity and efficiency, reduce labor costs, and develop high-quality products. Rising demand for efficient biomass processing is expected to boost the global hammer mill industry during the assessment period.

As the need for renewable energy sources rises, hammer mills play a vital role in processing biomass materials such as wood chips, agricultural residues, and straw for biofuel production. The growing need for these biomass materials will positively impact hammer mill sales.

The growing need for size reduction in feed production is another key factor creating growth prospects for the target market.

The demand for hammer mills is driven by the growing adoption in the feed production sector. Hammer mills provide efficient size reduction of grains, crops, and other feed ingredients, meeting the increasing demand for high-quality animal feed as global meat consumption rises

Established countries with well-established food processing and agricultural sectors may have a mature market for hammer mills. On the other hand, emerging nations undergoing swift industrialization and agricultural development may offer substantial market potential.

Key market participants compete fiercely for customers' business as producers work hard to deliver high-quality goods and satisfy a wide range of client wants. The demand for effective and dependable size reduction and processing solutions for a variety of materials is predicted to boost the hammer mill industry globally.

A noteworthy trend in the hammer mill industry is improved granulation profiles, energy efficiency, and rapid screen changeover. In recent years, hammer mills have undergone significant innovation and design changes. Manufacturers are focusing on product upgrades and differentiation to meet the increasing demand for more efficient and cost-effective machines.

One of the most notable advances in hammer mill technology is the improvement in granulation profiles. This feature allows for increased control over particle size distribution, resulting in higher-quality products. Another trend that has taken center stage is energy efficiency. As environmental concerns become more pressing, manufacturers are finding ways to reduce energy consumption without sacrificing performance.

New motor designs, variable frequency drives, and other innovations have led to significant improvements in this area. Further, rapid screen changeover has become a prominent feature of modern hammer mills.

Quick-change screens allow operators to switch between different sizes or types of screens with minimal downtime, greatly improving overall productivity. These innovations in hammer mills are expected to play a keen role in boosting global hammer mill sales revenues.

2018 to 2022 Global Hammer Mill Sales Outlook Compared to Demand Forecast from 2023 to 2033

The hammer mill market has been influenced by several factors. This includes the rising demand for processed food items, expansion of agriculture and biomass sectors, and technological improvements in hammer mill equipment.

Similarly, geographical aspects such as economic growth and governmental regulations have positively impacted global hammer mill sales.

Between 2010 and 2015, the market for hammer mills grew steadily, propelled by rising demand for processed food items as well as the rise of the agriculture and biomass sectors. The development of the market was further aided by technological developments in hammer mill equipment.

From 2018 and 2022, the target market grew moderately, with demand somewhat rising as people become more aware of the environmental advantages of using biomass as a fuel.

For the projection period (2023 to 2033), Future Market Insights (FMI) predicts the global market of hammer mills to thrive at 5.3% CAGR. It is anticipated to reach a valuation of US$ 5,677.3 million by 2033.

The exponential growth of end-use sectors such as food & beverage, agriculture, energy, mining, etc. is a prominent factor expected to uplift hammer mill demand.

The food & beverage remains one of the leading end users of hammer mills. This is due to the rising usage of hammer mills for tasks such as grinding, pulverizing, and particle size reduction of food ingredients, including grains, spices, herbs, and other raw materials.

The need for efficient and consistent food processing, improved product quality, and sustainable manufacturing practices is driving demand for hammer mills in this sector.

Consequently, technological advancements in hammer mill design and functionality, such as improved energy efficiency and automation features will boost the global market.

Why are Suppliers Increasingly Recommending Hammer Mills?

Hammer mills are becoming increasingly popular among suppliers due to their ease of installation, hassle-free operations, and optimum maintenance requirements. These machines offer a range of benefits that make them an ideal choice for businesses looking to expand their customer base while ensuring prompt after-sales service.

One of the main advantages of hammer mills is their simplicity when it comes to installation. Unlike other machinery, these mills require minimal setup time and can be up and running in a short amount of time. This not only saves precious time but also ensures that the production process starts without any delays.

The ease of installation also reduces labor costs, as there is no need for specialized personnel or heavy equipment.

Another key benefit offered by hammer mills is their hassle-free operation. These machines are designed with user-friendliness in mind and require little technical knowledge to operate effectively.

Hammer mills are adaptable equipment that can work with a variety of materials and tasks. They are capable of pulverizing, crushing, and grinding a wide range of substances, including grains, minerals, biomass, and more. Due to their flexibility, suppliers can meet the needs of various customers in several sectors.

Hammer mills are renowned for needing minimal maintenance. They are built with important components being easily accessible, which makes maintenance operations like cleaning, inspection, and part replacement more convenient and time-effective. Hammer mills' reduced maintenance downtime is one of their main selling points, according to suppliers.

What Makes the United Kingdom a Leading Hammer Mill Market across Europe?

Booming Agri-Food Sector Making the United Kingdom a Leading Market for Hammer Mills

As per Future Market Insights, Europe, spearheaded by the United Kingdom and Germany, holds a significant market share of 37% of the global hammer mill industry. This region's strong performance can be attributed to various factors such as a well-established industrial base, advancements in technology, and the presence of key market players.

Similarly, the emphasis on efficient and sustainable manufacturing practices in Europe is positively impacting hammer mill demand.

The United Kingdom is expected to remain one of the leading markets for hammer mills across Europe. This is due to rising applications of hammer mills across booming food & beverage and power & energy sectors.

The agri-food sector forms an important pillar of the United Kingdom’s GDP. The same sector contributed around US$ 126.9 billion to the national gross value added in 2020.

Robust expansion of agri-food sectors in turn is expected to uplift hammer mill demand during the projection period. This is due to rising applications of hammer mills in the agriculture and food & beverage sectors.

Competitive Landscape

Tier-1 players account for around 25% to 30% of the overall market with a revenue of more than US$ 200 million. These tiers I players include Hosokawa Micron Powder System, Andritz, Buhler Group, and others

Tier II and other players include manufacturers with total annual revenue between US$ 50 to 200 million from the sales of hammer mills.

Hammer mill manufacturers such as Schenck Process Holding Ltd GmbH, Hosokawa Micron Corp, L.B. Bohle Maschinen & Verfahren GmbH, and other regional and local players are expected to hold 30% to 35% of the market share.

Key hammer mill manufacturing companies are focusing on introducing new innovative, durable, and efficient products to stay relevant in the market. They are also implementing strategies such as facility expansions, mergers, partnerships, alliances, agreements, acquisitions, etc.

According to Future Market Insights, top hammer mill manufacturers are Hosokawa Micron Powder System, Andritz, Buhler Group, Schenck Process Holding Ltd GmbH, Hosokawa Micron Corp, L.B. Bohle Maschinen & Verfahren GmbH, etc.

Andritz: Andritz is an international technology group that provides a broad range of equipment, systems, and services for various sectors, including pulp and paper, hydropower, and other water management applications.

In 2022, the company recorded a revenue of 8,084.56 million. This progress was largely led by the grain hammer mills and mineral hammer mills. In 2023, the company’s focus is on profitable growth through investment in key and high-growth market segments, as well as doubling down on new business developments and internal investments to support its customers

Bühler: Bühler is a Swiss multinational corporation that specializes in the manufacture of food and feed processing equipment, including hammer mills. The company was founded in 1860 and has since become a leading supplier of equipment to the food and feed industries worldwide.

The company operates through the following segments: optical sorting machines, tubular bagging systems, continuous twin-screw extruders, hammer mills, etc.

Bühler's strategy is focused on developing innovative products and solutions that meet the evolving needs of customers in the food and feed processing sectors. The company invests heavily in research and development to stay at the forefront of technological advancements and to develop new products and services that can help customers optimize their operations.

Recent Developments:

In November 2022, Granulex 5, a new hammer mill series, was introduced by Buhler. The new hammer mills feature a groundbreaking modular system that offers significant energy savings and flexibility while maintaining product quality & safety standards. A new easy-clean mill was unveiled by Kemutec at POWTECH 2022. The new machine is ideal for hygiene-focused food applications.

In May 2023, Schenck Process Group sold its Food and Performance Material business to Hillenbrand, Inc.

These insights are based on a report on

Hammer Mill Market

by Future Market Insights

Source: Email/GFMM

Comment Now