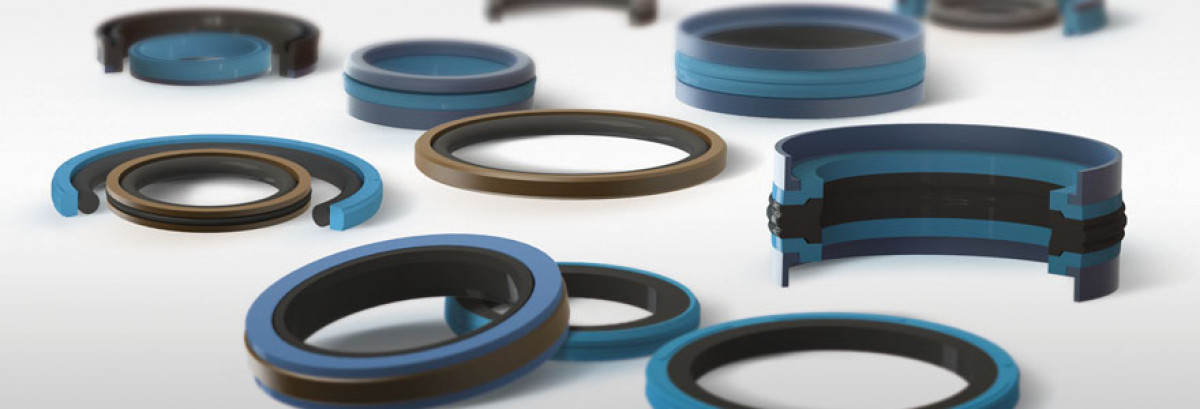

File Photo

The global piston seals market size is forecast to expand from US$ 2.3 billion in 2023 to US$ 3.4 billion by 2033. Over the next ten years (2023 to 2033), global piston seal sales are anticipated to soar at 3.8% CAGR. In 2022, the worldwide piston seals industry was valued at US$ 2.2 billion.

Futuristic market projections reveal that double-acting piston seals will remain the most popular type in the market. As per Future Market Insights, the double-acting piston seals segment is projected to thrive at a 3.5% CAGR through 2033.

To gain profits, key piston seal manufacturers are strengthening their portfolio of double-acting piston seals. For instance, recently, Hallite introduced a new double-acting, energized piston seal called ‘The Hallite 77 Piston Seal’.

Key Market-Shaping Factors:

· Robust expansion of end-use sectors such as automotive, aerospace, power generation, etc. will boost the global piston seals industry.

· Growing demand for leakage protection solutions in reciprocating motion machines, such as hydraulic pumps and cylinders to fuel piston seal sales.

· Rising popularity of custom-designed piston seals to create lucrative opportunities for piston seal manufacturers.

· Increasing demand for piston seals in heavy machinery will facilitate market expansion.

· Rapid industrialization to create lucrative growth prospects for piston seal companies.

Piston seals have become vital in machinery as they provide the ultimate in leakage control. They are generally made from materials such as nitrile rubber, polyamide, PTFE, and thermos-plastic polyurethane.

These hydraulic seals also reduce friction between the piston and the cylinder wall by providing a slippery surface. Without piston seals, the risk of failure of the hydraulic cylinder or hydraulic system increases.

Piston seals ensure that the pressurized fluid does not bypass the piston while the system pressure pushes the piston down the cylinder. Most of these seals are designed for the reciprocating motions used in pneumatic & hydraulic applications such as cylinders.

Growing focus on improving machine life and reducing wear and tear of components is expected to elevate piston seal demand. This is because piston seals prevent damage to machines by keeping the fluid from leaking and contaminating the environment.

Surging demand for piston seals in the thriving automotive sector due to increasing production and sales of passenger cars & commercial vehicles will boost the market. In recent years, there has been a dramatic rise in the production of vehicles globally due to factors such as population explosion, improving living standards, and economic growth.

For instance, as per the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached around 85 million in 2022 and this number is expected to further rise during the next few years. This will create a high demand for piston seals and boost the market.

The rising usage of piston seals in hydraulic systems due to their excellent properties such as temperature resistance and high-pressure resistance will fuel market expansion.

Piston seals are being widely used in hydraulic systems of heavy-duty construction machinery such as wheel loaders, excavators, and heavy-duty cranes. Hence, increasing production and sales of these heavy-duty machines will open a plethora of revenue-generation opportunities for piston seal manufacturers.

Leading piston seal manufacturers are concentrating on launching new fluid sealing solutions to meet end-user requirements. For instance, in November 2020, Kastas Sealing Technologies introduced the K501 new generation heavy-duty piston seal.

K501 piston seal offers features such as enhanced sealing, lower friction, and long service life. It is strengthened with polyamide material with special additives to meet high expectations for heavy-duty piston applications.

Similarly, in October 2021 a new range of high-quality polyurethane seals for light-medium and heavy-duty hydraulic cylinders & other hydraulic applications was introduced by Trelleborg.

The development of these new sealing solutions designed to meet users’ requirements for low friction, compact form, and simple installation will allow companies to significantly improve sales and expand their customer base.

Companies are also offering customized solutions which are helping them to attract more and more customers. These custom-made seals are designed to provide a high level of sealing performance, reliability, and durability.

2018 to 2022 Piston Seals Sales Outlook Compared to Demand Forecast from 2023 to 2033

As per Future Market Insights, global sales of piston seals increased at around 5.1% CAGR from 2018 to 2022. Looking forward, the global market for piston seals is set to thrive at a CAGR of 3.8% CAGR between 2023 and 2033. It is set to generate an absolute $ opportunity of US$ 1.0 billion during the projection period.

The rising usage of piston seals in a wide range of sectors such as automotive, aerospace, and heavy machinery is a prominent factor expected to drive the global market forward.

Piston seals have become essential solutions for maintaining sealing contact between a piston and cylinder bore. They are widely used in vehicles, airplanes, and other equipment.

Rising production and sales of passenger cars worldwide are expected to create a high demand for piston sales during the projection period. Subsequently, the growing usage of heavy machinery or heavy equipment across various sectors will positively influence global piston seal sales.

What is the Growth Projection for the United States Piston Seals Market?

Booming Aerospace Sector Bolstering Piston Seal Sales in the United States

According to Future Market Insights' (FMI) latest report, sales of piston seals in the United States are anticipated to soar at 3.8% CAGR during the assessment period. By 2033, the total market valuation is projected to reach around US$ 575.6 million.

From 2023 to 2033, the United States piston seals industry is anticipated to create an absolute $ opportunity of US$ 177.6 million.

Rising demand for piston seals from aerospace and heavy machinery sectors is a key factor boosting the United States market.

The United States is home to one of the leading aerospace sectors in the world. According to the Aerospace Industries Association (AIA), the aerospace & defense sector’s sales contributed around 18.8% of all non-food manufacturing revenue in the United States in 2020. Further, it accounted for 1.8% (around US$ 382 billion) of the total United States GDP.

As piston seals have become essential equipment in various aerospace applications, expansion of this sector will continue to power up sales during the next ten years.

Piston seals find application in actuators and landing gear where they ensure the sealing of pressurized fluids between the piston and the bore. They have become critical for reducing wear and tear, as well as improving overall performance of systems.

To meet this demand, leading companies are introducing novel aerospace piston seals with enhanced features. This will further boost the United States market.

Competitive Landscape

Leading piston seal manufacturers listed in the report include All Seals Inc., Boca Bearings, Inc., ElringKlinger AG, ElringKlinger Kunststofftechnik GmbH, Evco Seals, Kastas Sealing Technologies A.S., MSP Seals, Inc., SKF Group, SPC Group, and Garlock Sealing Technologies.

These key companies are focusing on developing solutions to meet changing end-user demand and boost their revenues. They are also adopting strategies such as partnerships, mergers, facility expansions, distribution agreements, acquisitions, and collaborations to gain a competitive edge in the market.

Recent developments:

· In March 2023, Hallite 777 double-acting piston seal was launched by Hallite at IFPE. It is a compact seal designed for medium to heavy-duty applications across various industries.

· In November 2022, SKF Group completed the acquisition of Tenute Srl., a leading developer and manufacturer of sealing solutions for various industrial applications. The new seal is available in more cost-effective material options for less demanding applications.

· In October 2022, to produce high-quality sealing products and provide its customers with innovative and reliable sealing technologies, Kastas Sealing Technologies, opened its new Kastas Italy Branch in Verona.

· In October 2021, Trelleborg, a leading manufacturer of sealing solutions such as hydraulic seals, O-Rings, pneumatic seals, oil seals, static seals, and mechanical face seals, introduced new PU seals for its fluid power customers in the Americas.

· In 2021, Universal Seal introduced its new seal for hydraulic cylinders. The new sealing solution can thrive in complex operating solutions and is ideal for high-pressure applications.

These insights are based on a report on

piston seals market

by Future Market Insights

Source: Email/GFMM

Comment Now